Digital Customer Onboarding Challenges

You never get a second chance to make a first impression, as the saying goes. As a leader and decision-maker in a complex and highly-regulated field (such as fintech or online betting) the pressure’s on you to get it right. How your company brings new customers onboard will have an enduring effect on your relationship with them.

At stake, oddly enough, is money. Your customer onboarding process flow will have a significant effect on your bottom line. Firstly, through the number of customers you acquire in the first place. And secondly, because it affects your ability to sell them other services when you’ve got them there. There are few things more frustrating than untapped potential.

It’s all about being cost effective from Day One. And remaining cost effective for as long as your relationship with your customer lasts. You may choose to see this as either a gentle prompt, or a veiled threat. It’s not as if there’s a shortage of competition in your field.

Let’s have a look at what can go wrong with the customer onboarding journey.

When customer onboarding pushes customers overboard

80% of companies say they deliver "superior" customer service. Only 8% of people believe themBain & Company

Over 50 % of customer onboarding applications drop off half way through. This is pretty standard in the financial sector. Whether this is unacceptably high or not, only you can say. It depends on what people are prepared to tolerate. What sort of conversation does this spark off with your CFO?

To continue with the ‘stats of doom’ theme, 34 % of people who click off in a fit of frustration do so because the provider is asking them for too much information, making the process needlessly complicated. Your customers do not have a limitless reserve of patience. (Do you?) You can make it easier for them by developing a customer onboarding template to serve their needs (and ultimately, yours).

Perhaps that means working with a supportive customer onboarding specialist who knows their stuff, and just as importantly, your stuff.

Who we are

Habitable.co is based in London, from where we find human solutions to complex CX problems

all over Europe. Our mission is to help you get your digital customers onboard without friction or fuss.

This will improve your company’s financial performance by

1/ Saving you money by reducing the cost of each customer acquisition

2/ Enabling you to sell more services to your customers, growing the lifetime value of every customer

We specialise in Premium Customer Experience and Human Centered Design. We’re not assuming

for a moment that you’re hearing these terms for the first time. But here’s a recap so we all know we’re on the same page.

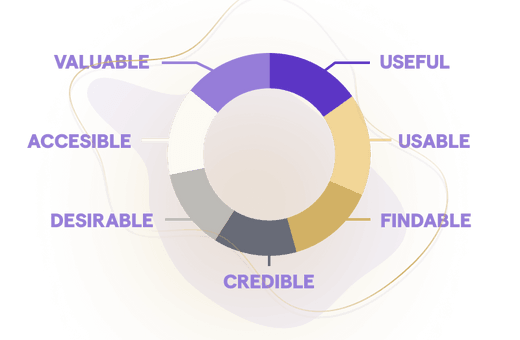

Premium Customer Experience

We create Premium Custom Experience by delivering an advanced level of customer service that goes beyond basic service activities to include a more personalised and customised approach. Which makes it clear to your customer that, in your eyes, their needs come first.

Human Centered Design

Human-centered design (HCD) is an approach to creating solutions for problems and opportunities

through a focus on the needs, contexts, behaviors, and emotions of the people that the solutions will serve.

Through research, our teams immerse themselves in situations where customers use their product. By close observation

of the thoughts, actions and experiences of people, they achieve empathy - a deep understanding of how and why people

behave as they do. With this understanding they create potential solutions, which they prototype and evaluate

in a rigorous iterative process, spotting and developing those that best fit people’s lives.

Who we work with

As a glance at the companies we serve will reveal, the more complex and highly-regulated the industry you work in, the more likely you are to need our expertise. We’re proud to number among our clients

- Banks

- Insurance Providers

- Brokerage companies

- FX Trading and Investment platforms

- Wealth Management platforms

- Crypto-wallets

- Cryptocurrency exchanges

- Healthcare providers

- Betting services

Within our client portfolio we have Enterprise-level companies such as Allianz, Avast and Coinbase. Mid-market companies including Home Credit, Dovera, J&T Bank, Nike and many more. We’re also proud to support pioneering SMEs and start-ups like 365.bank and ahoj.shopping BNPL

How do we make Customer Onboarding work?

Ok, let’s break it down. There are two stages where we apply our customer onboarding expertise. These are Master-onboarding (becoming a customer) and Micro-onboarding (applying for a new service like a loan or credit card). These are the tools we can create for you, to make the journey seamless and help you develop a lasting and profitable relationship with your customers

- ID verification

- Document provision (such as NDAs and compliance documents)

- Credit scoring

- Account and profile creation

- Transitioning from sales to account management

- App tutorials/wizards

- Customer support, email, and chat campaigns

How we operate

We choose to work in a smaller team with concentrated brain-power. Our 50-strong core of colleagues contains Researchers, Architects, UX/UI Designers, CX Leads and Engineers. All of them will collaborate seamlessly for your benefit. Beyond our core group, we curate a rapidly growing network of top talent, which we can mobilise to boost your capacity for expansion.

Can we help in some way?

If you’re looking for a partner to help you convert your digital potential into customers and cash, we’d love to have you onboard. Please feel free to bring us your challenges - our Founder & CEO Juraj Rosa is very keen to hear them.

Get in touch