Digital Onboarding: The What, The How, and Everything In Between

More and more millennials are switching banks for a better mobile experience. According to a special report published by BAI, Gen Xers are increasingly using digital methods to open savings and loan accounts.

In today's world, customers expect a modern, fast, and flawless digital customer onboarding experience. Neobanks and SaaS companies have set the bar high, and to keep up, you must provide a similar level of service.

Would it be possible to forgo a smooth digital onboarding experience for new customers?

No, and here are three reasons that would be disastrous for your business in the long term.

Missed opportunity

Experian's study showed that a whopping 85% of potential customers are lost during the digital onboarding process - which banks are struggling with. Around 35% of customers cannot be identified, and a similar number give up because the process is too long and challenging. Only 15% of customers can complete the onboarding process and become paying clients. Any business that wants to succeed in the 21st century cannot afford to lose 85% of potential customers.

Cost of acquisition

When considering the cost of new customers, it's important to remember that it takes an average of two years for a bank to make back its investment, according to Howard Lax of CustomerThink. With a 40% chance of new customers leaving, every new customer becomes a costly gamble.

For a large bank, acquiring a new retail banking customer could cost between $1,500 and $2,000. Therefore, digital onboarding is the most significant area of weakness and missed opportunity for banks in the Western world.

Customer lifetime value

Customer lifetime value (CLV) is a key metric for businesses. It describes how much a business can expect to earn from its average customer throughout their relationship.

The average lifetime value of a banking customer is estimated to be between $2000 and $4000, according to a study conducted by Novantas. If a bank can provide both business and household financial services, the CLV for a small business banking relationship could be as high as $10,000.

What you need to consider when onboarding customers digitally

Onboard customers quickly

You need to keep speed in mind when onboarding customers, as you only have a limited time. The quicker you can welcome them onboard, the fewer dropouts you'll have.

Orchestrate the customer lifecycle from start to finish

Orchestrate the customer lifecycle from start to finish, covering the entire journey, from acquisition and multi-product origination to customer support and off-boarding.

Drive revenue

Digitizing the process of gathering customer information and documents can help reduce the manual work for your employees and free them up to provide better customer service.

What is digital onboarding?

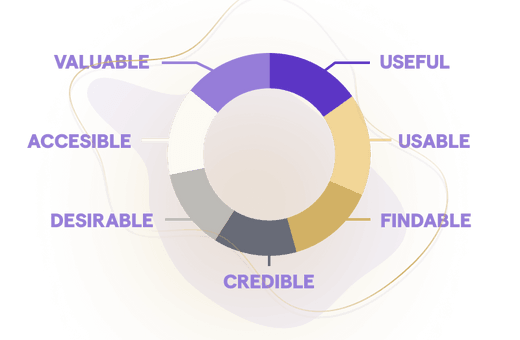

Adding new customers to your database or CRM using online tools and software is called digital onboarding. Customers can learn about your product or service from anywhere without coming to your store or office.

Digital onboarding is conducted online, as opposed to in person. Customers can sign up and interact with your company on your website or mobile app and do it on their own time.

One of the main benefits of digital onboarding is that customers can start the process at any time and place that is convenient for them. They don't have to come to your office or store and do it on your schedule. There are other benefits to digital onboarding, which we will discuss later.

To finish the digital onboarding process, customers must supply some form of identification or authentication. This might be personal information like an email address, birthday, or social security number. In other instances, it could be biometric data, like a fingerprint or face scan.

The onboarding process for new digital customers usually involves a lot of automation, such as signing up, making purchases, and resolving inquiries. New clients will also have to fill out a questionnaire and be given product info through instructional videos and articles. Lastly, banks and other financial institutions must verify the customer's identity through KYC (Know Your Customer).

Additional Types of Onboarding

On-Site Onboarding

On-site onboarding involves a new customer entering a store or office to complete the onboarding process. This process requires the customer to verify their identity and provide personal information in person. Customers would also have to return to your location whenever they need to update the information you have on file, like if they needed help getting up to speed with your product or service.

Semi-On-Site Onboarding

With semi-on-site onboarding, customers enter the store for an initial overview of the product and are given self-study resources to take home. They then return to their preferred location and begin onboarding on their own time.

For example, if a customer came in to sign up for your service and you sent them a set of digital forms to fill out at home, you could then offer them the option to submit the forms in person or send them back over email.

While hybrid onboarding may seem like the best of both worlds, managing both physical and digital files can be complex for your customer onboarding specialists to handle.

Benefits of Digital Onboarding

There are several advantages to using digital onboarding for your business.

- For starters, digital onboarding is more automated than traditional methods. This can save your business time and money.

- It can also help you build better relationships with your customers.

- Digital onboarding also allows you to collect more data about your customers. This data can help you improve your products and services.

Best Practices for Digital Onboarding

There are some similarities between the best practices for digital onboarding and the best practices for customer onboarding in general, but there are also some important differences. Let's explore a few of those below.

You need to understand your customers and what they want

Onboarding can be tricky, especially when customers are new to your product. But by looking at their questions and finding ways to answer them, you can help make the process smoother and more successful.

Since they won't have anyone to help them in person, customers need to be more independent when activating their product or service and answering their questions. So, you should give them the tools they need to be successful.

What are the questions your customers ask most often during the onboarding process? Try to answer them.

Do they get stuck during the technical setup of your product? You might want to consider including video tutorials to help them out.

Do they abandon onboarding because they don't know what to do next? Maybe sending them emails with instructions would be helpful.

It's always important to think about ways to improve your customer's experience, but this is especially true when they're going through digital onboarding.

A consistent multi-channel experience is key

With many mobile internet users, your onboarding experience must be adaptable and easy to use on any device.

Your customers should have the same experience regardless of their device. For example, if they start creating an account on their desktop, they should be able to finish it on their phone or tablet.

Make sure your new customers can connect with your success team

Your success team should still be accessible to new customers even after switching to a digital onboarding program.

Your support representatives may not be physically present during the onboarding process, but they can still help new customers become regular users.

Make sure customers know how to reach your support team if they have questions.

At Habitable, we're always working to help our clients improve their digital customer onboarding rates

We've helped dozens of companies set and optimize their own customer onboarding rates, and we can do the same for you. Visit Customer Onboarding to schedule a strategy call today.

Get in touch